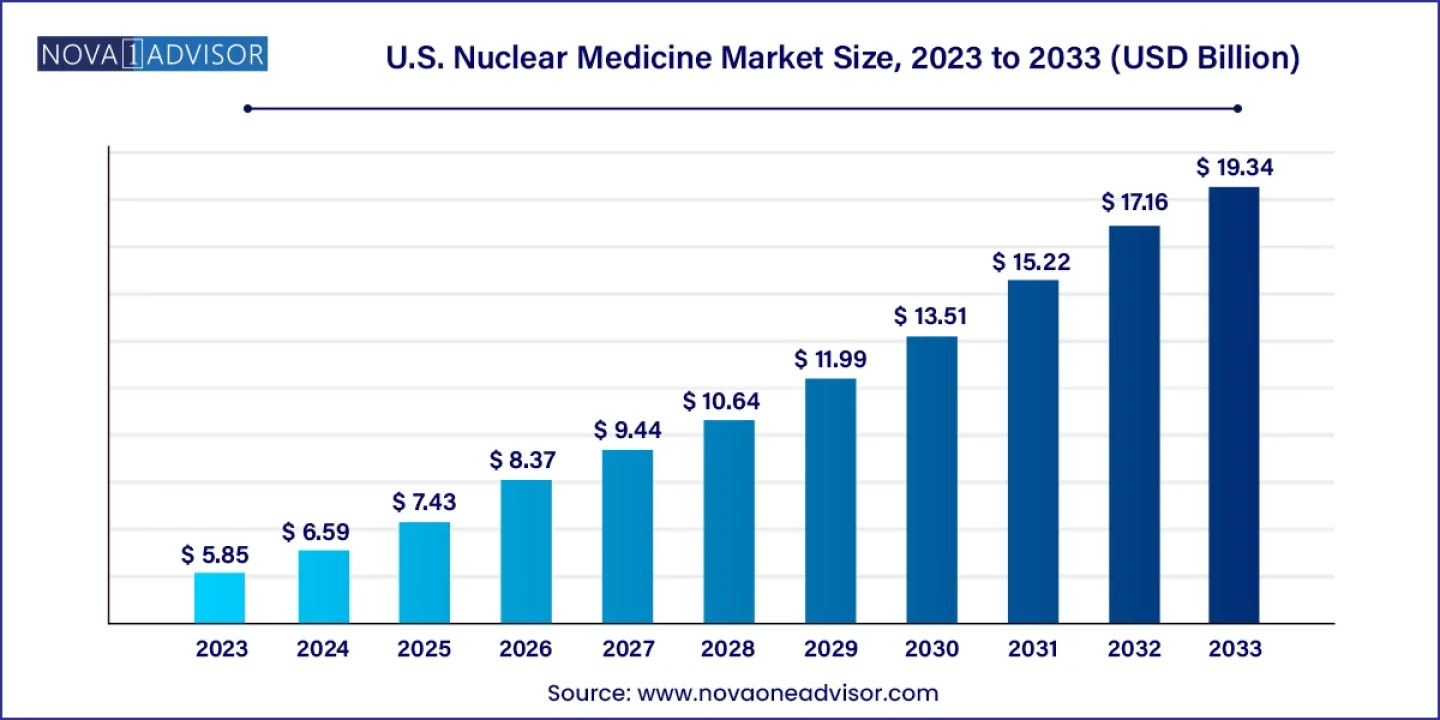

According to recent study by Nova one advisor, the U.S. nuclear medicine market size was estimated at USD 5.85 billion in 2023 and is projected to hit around USD 19.34 billion by 2033, growing at a CAGR of 12.7% during the forecast period from 2024 to 2033.

According to recent study by Nova one advisor, the U.S. nuclear medicine market size was estimated at USD 5.85 billion in 2023 and is projected to hit around USD 19.34 billion by 2033, growing at a CAGR of 12.7% during the forecast period from 2024 to 2033.

Get Sample Copy of Report@ https://www.novaoneadvisor.com/report/sample/8497

The increasing incidence of cancer and cardiovascular illnesses in the United States is driving market growth. According to American Cancer Society statistics, the number of new cancer cases in the United States is expected to reach 1,958,310 in 2023, with 609,820 cancer-related fatalities. Technological breakthroughs in nuclear medicine, combined with an increasing demand for reliable diagnostic and treatment procedures, are accelerating expansion even further.

Cardiovascular illnesses are the main cause of death for persons of all ethnicities and races in the United States. According to a CDC study published in May 2023, around 805,000 people in the United States experience heart attacks each year, with 605,000 of these individuals experiencing their first episode. As a result, between 2018 and 2019, the United States government spent around USD 239 billion on the prevention and treatment of heart disease. This includes the cost of pharmaceuticals and health-care services. Alcohol consumption, poor diet, and a lack of exercise are all risk factors for cancer and heart disease. As a result, the rapid rise in the incidence of cancer and cardiovascular diseases is expected to increase demand for nuclear medicine in the United States.

Technological improvements in the global nuclear medicine industry are accelerating its expansion. Radiopharmaceuticals have revolutionized diagnosis and therapy methods in cardiology and oncology. Continuous research and studies demonstrate the efficacy of radioisotopes in a variety of medical domains, driving their use in diagnosing and treating cancer, thyroid-related diseases, respiratory disorders, bone conditions, and digestive tract maladies. The increasing exploration in nuclear medicine encourages the development of novel products tailored to diagnostic and therapeutic goals, ultimately promoting growth in the area. For example, in June 2022, Siemens Healthineers unveiled Symbia Pro.specta, an innovative SPECT and CT imaging system.

Furthermore, this innovative product has acquired U.S. FDA authorization with the CE mark for use in a variety of applications, including patient type, clinical studies, and departments. Furthermore, this product has an intuitive and automated workflow that guides the user through the entire examination decision-making process, automatic SPECT motion correction for increased image clarity, and a low-dose CT of up to 64 parts for enhanced information, giving it a competitive advantage over other radiopharmaceutical products on the market.

The growing demand for accurate diagnosis and treatment procedures drives market expansion. Positron Emission Tomography (PET) uses radioisotopes to diagnose specific organs. Its use as a diagnostic tool is rapidly increasing due to its greater accuracy when compared to other diagnostic procedures. PET's excellent diagnostic accuracy and effectiveness in tracking therapy progress help physicians make better decisions. PET is routinely coupled with X-rays and computed tomography to improve diagnostic accuracy. Positrigo AG announced the debut of its dedicated PET system NeuroLF in the United States in October 2023, following the formation of a company there. Thus, R&D for novel nuclear medicine products, as well as increased demand for these diagnostic techniques, are likely to drive market expansion throughout the forecast period.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/8497

U.S. Nuclear Medicine Market Key Takeaways

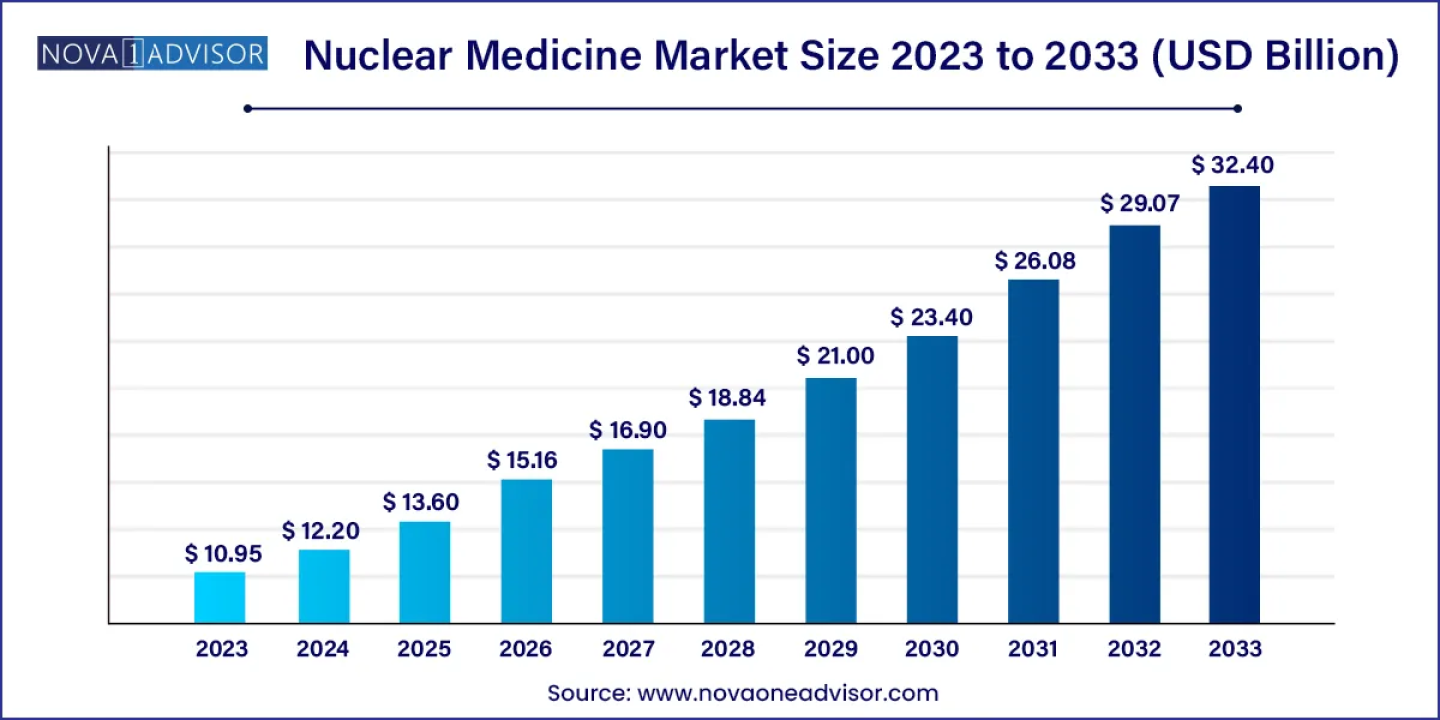

The global nuclear medicine market size was valued at USD 10.95 billion in 2023 and is anticipated to reach around USD 32.40 billion by 2033, growing at a CAGR of 11.46% from 2024 to 2033. North America dominated the market with a revenue share of 47.14 % in 2023.

Nuclear medicine is used to diagnose a wide range of conditions.

The patient will inhale, swallow, or be injected with a radiopharmaceutical. This is a radioactive material. After taking the substance, the patient will normally lie down on a table, while a camera takes pictures.

The camera will focus on the area where the radioactive material is concentrated, and this will show the doctor what kind of a problem there is, and where it is.

Types of imaging techniques include positon emission tomography (PET) and single-photon emission computed tomography (SPECT).

PET and SPECT scans can provide detailed information about how a body organ is functioning.

This type of imaging is particularly helpful for diagnosing thyroid disease, gall bladder disease, heart conditions, and cancer. It can also help diagnose Alzheimer’s disease and other types of dementia and brain conditions.

In the past, diagnosing internal problems often needed surgery, but nuclear medicine makes this unnecessary.

After diagnosis, and when treatment starts, PET and SPECT can show how well the treatment works.

PET and SPECT are also offering new insights into psychiatric conditions, neurological disorders, and addiction.

Other types of imaging involved in nuclear medicine include targeted molecular ultrasound, which is useful in detecting different kinds of cancer and highlighting blood flow; and magnetic resonance sonography, which has a role in diagnosing cancer and metabolic disorders.

U.S. Nuclear Medicine Market Top Trends

https://www.novaoneadvisor.com/report/checkout/8497

U.S. Nuclear Medicine Market by Product Insights

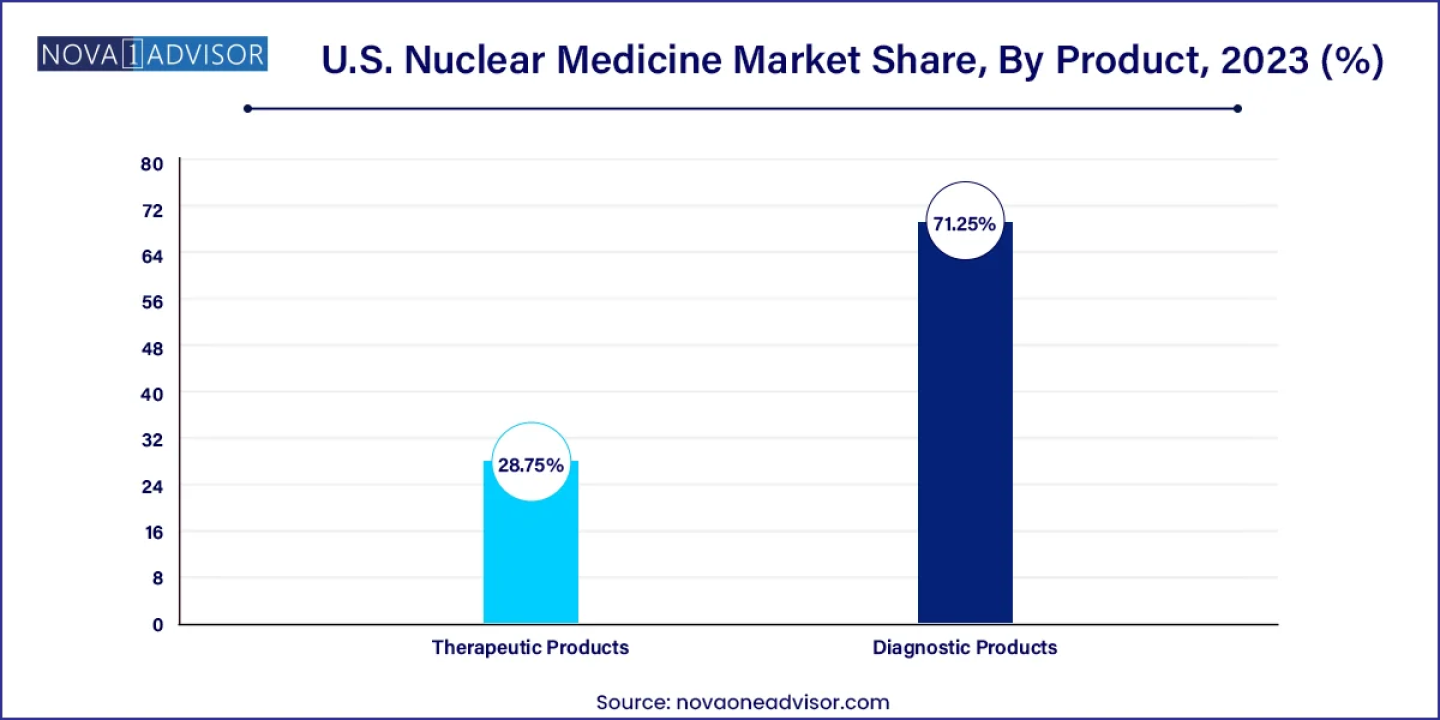

The diagnostic products segment dominated the market and accounted for 71.25% of the global revenue in 2023. SPECT is employed for the diagnosis of a wide range of diseases and conditions, including neurological disorders, cardiovascular diseases, and thyroid-related conditions. The accuracy of the SPECT diagnostic technique is better than other non-radiopharmaceutical techniques. SPECT held the largest market share in 2023, owing to the low cost of scans and the ability to use easily obtained radioisotopes with longer life, compared to PET. In addition, the introduction of dedicated gamma cameras, portable SPECT scanners, and the development of the I-123 radiotracer are factors expected to boost the market.

The therapeutic products segment is anticipated to grow at the fastest CAGR over the forecast period. Alpha emitters, beta emitters, and brachytherapy are widely employed in radiopharmaceutical therapeutic procedures. Brachytherapy is commonly used as a treatment option for prostate, gynecological, breast, and other cancers due to its advantages, such as short procedure time. Major players are finding novel ways of using I-131 to treat various other diseases. For instance, in December 2023, Cellectar Biosciences, Inc., a clinical biopharmaceutical company, recently expanded its collaboration with the Wisconsin Alumni Research Foundation (WARF). The collaboration focuses on developing and commercializing iopofosine I 131 for pediatric cancers. This agreement grants Cellectar an exclusive license to work on iopofosine in pediatric solid cancers like high-grade glioma, neuroblastoma, and sarcoma.

U.S. Nuclear Medicine Market by End-use Insights

Hospitals & clinics dominated the market with the largest share in 2023. The nuclear medicine market in the U.S. is expanding due to the rise in the number of hospitals and clinics. The demand for nuclear medicine products is high owing to rising inpatient visits for diagnosis and treatment of diseases. According to the American Hospital Association, in 2024, around 6,120 hospitals were operating across different U.S. states, with 33.67 million hospital admissions. The availability of skilled staff and the ability to buy high-cost nuclear medicine products owing to the high budget are key factors expected to drive the segment.

The diagnostic centers segment is projected to witness significant growth rate over the forecast period. The diagnostic centers segment is growing due to the rising number of nuclear medicine diagnostic procedures. As per the National Cancer Institute, in 2023, nearly 2 million people were diagnosed with cancer in the U.S. Thus, the rising incidence of chronic diseases is expected to boost the diagnosis rate during the forecast period, driving market growth.

U.S. Nuclear Medicine Market by Application Insights

The oncology segment dominated the market with the largest share 25.85% in 2023, due to high cancer prevalence and increased preference for radiopharmaceutical diagnosis. As per the American Cancer Society’s 2022 statistics, it is estimated that there will be approximately 1.9 million new cancer cases diagnosed and 609,360 cancer-related deaths in the U.S. in 2022. This pervasive presence of cancer has a direct influence on the growth of the market. The demand for nuclear medicine technologies is expected to rise as they play a crucial role in diagnosing and treating various cancers.

The endocrine tumor segment is anticipated to grow at the fastest CAGR over the forecast period. Endocrine tumors originate from the gastroenteropancreatic tract and are defined by histological pattern & endocrine metabolism. Endocrine tumors are rare types of tumors that affect 2.5 to 5 people in every 100,000, according to statistics released by the National Cancer Institute U.S. For the detection of endocrine tumors, radiopharmaceuticals and functional imaging tools are preferred over CT, MRI, and ultrasound. The competitive landscape is influenced by the strategic initiatives of key players. For instance, recent collaboration between Jubilant Draximage Inc. (Jubilant Radiopharma) and Evergreen Theragnostics, Inc. in June 2023. Jubilant Radiopharma, with its Radiopharmacy business division holding one of the largest nuclear medicine pharmacy networks in the U.S., agreed with Evergreen Theragnostics.

U.S. Nuclear Medicine Market Recent Developments

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Nuclear Medicine market.

By Product

https://www.novaoneadvisor.com/report/checkout/8497

Frequently Asked Questions

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/

Get Sample Copy of Report@ https://www.novaoneadvisor.com/report/sample/8497

The increasing incidence of cancer and cardiovascular illnesses in the United States is driving market growth. According to American Cancer Society statistics, the number of new cancer cases in the United States is expected to reach 1,958,310 in 2023, with 609,820 cancer-related fatalities. Technological breakthroughs in nuclear medicine, combined with an increasing demand for reliable diagnostic and treatment procedures, are accelerating expansion even further.

Cardiovascular illnesses are the main cause of death for persons of all ethnicities and races in the United States. According to a CDC study published in May 2023, around 805,000 people in the United States experience heart attacks each year, with 605,000 of these individuals experiencing their first episode. As a result, between 2018 and 2019, the United States government spent around USD 239 billion on the prevention and treatment of heart disease. This includes the cost of pharmaceuticals and health-care services. Alcohol consumption, poor diet, and a lack of exercise are all risk factors for cancer and heart disease. As a result, the rapid rise in the incidence of cancer and cardiovascular diseases is expected to increase demand for nuclear medicine in the United States.

Technological improvements in the global nuclear medicine industry are accelerating its expansion. Radiopharmaceuticals have revolutionized diagnosis and therapy methods in cardiology and oncology. Continuous research and studies demonstrate the efficacy of radioisotopes in a variety of medical domains, driving their use in diagnosing and treating cancer, thyroid-related diseases, respiratory disorders, bone conditions, and digestive tract maladies. The increasing exploration in nuclear medicine encourages the development of novel products tailored to diagnostic and therapeutic goals, ultimately promoting growth in the area. For example, in June 2022, Siemens Healthineers unveiled Symbia Pro.specta, an innovative SPECT and CT imaging system.

Furthermore, this innovative product has acquired U.S. FDA authorization with the CE mark for use in a variety of applications, including patient type, clinical studies, and departments. Furthermore, this product has an intuitive and automated workflow that guides the user through the entire examination decision-making process, automatic SPECT motion correction for increased image clarity, and a low-dose CT of up to 64 parts for enhanced information, giving it a competitive advantage over other radiopharmaceutical products on the market.

The growing demand for accurate diagnosis and treatment procedures drives market expansion. Positron Emission Tomography (PET) uses radioisotopes to diagnose specific organs. Its use as a diagnostic tool is rapidly increasing due to its greater accuracy when compared to other diagnostic procedures. PET's excellent diagnostic accuracy and effectiveness in tracking therapy progress help physicians make better decisions. PET is routinely coupled with X-rays and computed tomography to improve diagnostic accuracy. Positrigo AG announced the debut of its dedicated PET system NeuroLF in the United States in October 2023, following the formation of a company there. Thus, R&D for novel nuclear medicine products, as well as increased demand for these diagnostic techniques, are likely to drive market expansion throughout the forecast period.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/8497

U.S. Nuclear Medicine Market Key Takeaways

- The diagnostic products segment dominated the market and accounted for 71.25% of the global revenue in 2023.

- The therapeutic products segment is anticipated to grow at the fastest CAGR over the forecast period.

- Hospitals & clinics dominated the market with the largest share in 2023.

- The diagnostic centers segment is projected to witness significant growth rate over the forecast period.

- The oncology segment dominated the market with the largest share 25.85% in 2023

- The endocrine tumor segment is anticipated to grow at the fastest CAGR over the forecast period.

The global nuclear medicine market size was valued at USD 10.95 billion in 2023 and is anticipated to reach around USD 32.40 billion by 2033, growing at a CAGR of 11.46% from 2024 to 2033. North America dominated the market with a revenue share of 47.14 % in 2023.

Nuclear medicine is used to diagnose a wide range of conditions.

The patient will inhale, swallow, or be injected with a radiopharmaceutical. This is a radioactive material. After taking the substance, the patient will normally lie down on a table, while a camera takes pictures.

The camera will focus on the area where the radioactive material is concentrated, and this will show the doctor what kind of a problem there is, and where it is.

Types of imaging techniques include positon emission tomography (PET) and single-photon emission computed tomography (SPECT).

PET and SPECT scans can provide detailed information about how a body organ is functioning.

This type of imaging is particularly helpful for diagnosing thyroid disease, gall bladder disease, heart conditions, and cancer. It can also help diagnose Alzheimer’s disease and other types of dementia and brain conditions.

In the past, diagnosing internal problems often needed surgery, but nuclear medicine makes this unnecessary.

After diagnosis, and when treatment starts, PET and SPECT can show how well the treatment works.

PET and SPECT are also offering new insights into psychiatric conditions, neurological disorders, and addiction.

Other types of imaging involved in nuclear medicine include targeted molecular ultrasound, which is useful in detecting different kinds of cancer and highlighting blood flow; and magnetic resonance sonography, which has a role in diagnosing cancer and metabolic disorders.

U.S. Nuclear Medicine Market Top Trends

- Technological Advancements: The field of nuclear medicine continues to benefit from technological advancements, particularly in imaging modalities such as positron emission tomography (PET) and single-photon emission computed tomography (SPECT). These advancements enable more accurate diagnoses, personalized treatment plans, and improved patient outcomes.

- Theranostics: Theranostics, the integration of diagnostic imaging and targeted therapy, is gaining traction in nuclear medicine. This approach allows physicians to visualize and treat diseases at the molecular level, leading to more precise and effective treatments for conditions such as cancer and neurological disorders.

- Radiopharmaceutical Development: There is a growing emphasis on the development of novel radiopharmaceuticals for both diagnostic and therapeutic applications. These include targeted radiotracers for imaging specific biomarkers as well as radiopharmaceuticals for targeted radionuclide therapy (TRT), which deliver radiation directly to diseased cells while sparing healthy tissue.

- Shift towards PET Imaging: PET imaging is increasingly becoming the preferred modality for various clinical applications due to its high sensitivity, ability to quantify molecular processes, and versatility in oncology, cardiology, neurology, and other fields. As a result, there's a rising demand for PET radiotracers and imaging systems in the market.

- Growing Clinical Applications: Nuclear medicine techniques are finding new clinical applications beyond oncology, such as cardiology, neurology, and musculoskeletal imaging. This expansion of indications broadens the market potential and contributes to the overall growth of the nuclear medicine sector.

- Integration with Artificial Intelligence (AI): The integration of artificial intelligence and machine learning algorithms is enhancing the efficiency and accuracy of nuclear medicine procedures. AI-driven tools are being developed to assist in image interpretation, disease detection, treatment planning, and outcome prediction, thereby optimizing clinical workflow and decision-making.

- Regulatory Landscape and Reimbursement Policies: Regulatory approvals and reimbursement policies play a crucial role in shaping the nuclear medicine market. Changes in regulations, such as expedited approval pathways for innovative radiopharmaceuticals, and revisions in reimbursement policies impact market dynamics and influence investment decisions by industry players.

- Focus on Patient-centric Care: There's a growing focus on patient-centric care within the nuclear medicine field, with efforts to minimize radiation exposure, improve imaging protocols for enhanced patient comfort, and personalize treatment strategies based on individual patient characteristics and response to therapy.

https://www.novaoneadvisor.com/report/checkout/8497

U.S. Nuclear Medicine Market by Product Insights

The diagnostic products segment dominated the market and accounted for 71.25% of the global revenue in 2023. SPECT is employed for the diagnosis of a wide range of diseases and conditions, including neurological disorders, cardiovascular diseases, and thyroid-related conditions. The accuracy of the SPECT diagnostic technique is better than other non-radiopharmaceutical techniques. SPECT held the largest market share in 2023, owing to the low cost of scans and the ability to use easily obtained radioisotopes with longer life, compared to PET. In addition, the introduction of dedicated gamma cameras, portable SPECT scanners, and the development of the I-123 radiotracer are factors expected to boost the market.

The therapeutic products segment is anticipated to grow at the fastest CAGR over the forecast period. Alpha emitters, beta emitters, and brachytherapy are widely employed in radiopharmaceutical therapeutic procedures. Brachytherapy is commonly used as a treatment option for prostate, gynecological, breast, and other cancers due to its advantages, such as short procedure time. Major players are finding novel ways of using I-131 to treat various other diseases. For instance, in December 2023, Cellectar Biosciences, Inc., a clinical biopharmaceutical company, recently expanded its collaboration with the Wisconsin Alumni Research Foundation (WARF). The collaboration focuses on developing and commercializing iopofosine I 131 for pediatric cancers. This agreement grants Cellectar an exclusive license to work on iopofosine in pediatric solid cancers like high-grade glioma, neuroblastoma, and sarcoma.

U.S. Nuclear Medicine Market by End-use Insights

Hospitals & clinics dominated the market with the largest share in 2023. The nuclear medicine market in the U.S. is expanding due to the rise in the number of hospitals and clinics. The demand for nuclear medicine products is high owing to rising inpatient visits for diagnosis and treatment of diseases. According to the American Hospital Association, in 2024, around 6,120 hospitals were operating across different U.S. states, with 33.67 million hospital admissions. The availability of skilled staff and the ability to buy high-cost nuclear medicine products owing to the high budget are key factors expected to drive the segment.

The diagnostic centers segment is projected to witness significant growth rate over the forecast period. The diagnostic centers segment is growing due to the rising number of nuclear medicine diagnostic procedures. As per the National Cancer Institute, in 2023, nearly 2 million people were diagnosed with cancer in the U.S. Thus, the rising incidence of chronic diseases is expected to boost the diagnosis rate during the forecast period, driving market growth.

U.S. Nuclear Medicine Market by Application Insights

The oncology segment dominated the market with the largest share 25.85% in 2023, due to high cancer prevalence and increased preference for radiopharmaceutical diagnosis. As per the American Cancer Society’s 2022 statistics, it is estimated that there will be approximately 1.9 million new cancer cases diagnosed and 609,360 cancer-related deaths in the U.S. in 2022. This pervasive presence of cancer has a direct influence on the growth of the market. The demand for nuclear medicine technologies is expected to rise as they play a crucial role in diagnosing and treating various cancers.

The endocrine tumor segment is anticipated to grow at the fastest CAGR over the forecast period. Endocrine tumors originate from the gastroenteropancreatic tract and are defined by histological pattern & endocrine metabolism. Endocrine tumors are rare types of tumors that affect 2.5 to 5 people in every 100,000, according to statistics released by the National Cancer Institute U.S. For the detection of endocrine tumors, radiopharmaceuticals and functional imaging tools are preferred over CT, MRI, and ultrasound. The competitive landscape is influenced by the strategic initiatives of key players. For instance, recent collaboration between Jubilant Draximage Inc. (Jubilant Radiopharma) and Evergreen Theragnostics, Inc. in June 2023. Jubilant Radiopharma, with its Radiopharmacy business division holding one of the largest nuclear medicine pharmacy networks in the U.S., agreed with Evergreen Theragnostics.

U.S. Nuclear Medicine Market Recent Developments

- In December 2023, Eli Lilly and Company has recently finalized a definitive agreement to acquire POINT Biopharma, Inc., a prominent radiopharmaceutical company. This strategic maneuver is geared towards broadening Lilly's capabilities within the oncology sector, with a particular emphasis on advancing next generation radioligand therapies.

- In November 2023, BWXT Medical, a subsidiary of BWX Technologies, is set to supply Fusion Pharmaceuticals with generators for producing actinium-225, a crucial medical isotope in cancer treatment trials. This agreement grants Fusion a preferential radium-225 supply and access to advanced generator technology, supporting the manufacturing of Ac-225 for clinical trials.

- In November 2023, Telix Pharmaceuticals has strategically initiated the acquisition of radiopharmaceutical company QSAM for a significant USD 125 million. The structured payment plan includes an initial USD 2 million upfront, USD 33 million upon closing, and potential milestone-based payments of up to USD 90 million. The acquisition encompasses QSAM's lead therapeutic agent, CycloSam. Expected to conclude in Q1 2024.

- Eckert & Ziegler

- Curium

- GE Healthcare

- Jubilant Life Sciences Ltd.

- Bracco Imaging S.P.A

- Nordion (Canada), Inc.

- The Institute For Radioelements (IRE)

- NTP Radioisotopes SOC Ltd.

- Eczacıbaşı-Monrol

- Lantheus Medical Imaging, Inc.

- The Australian Nuclear Science and Technology Organization

- Novartis (Advanced Accelerator Applications)

- Siemens Healthineers AG

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Nuclear Medicine market.

By Product

- Diagnostic Products

- SPECT

- TC-99m

- TL-201

- GA-67

- I-123

- Other SPECT Products

- PET

- F-18

- SR-82/RB-82

- Other PET products

- Therapeutic Products

- Alpha Emitters

- RA-223

- Others

- Beta Emitters

- I-131

- Y-90

- SM-153

- Re-186

- Lu-117

- Other Beta Emitters

- Brachytherapy

- Cesium-131

- Iodine-125

- Palladium-103

- Iridium-192

- Other Brachytherapy Products

- Alpha Emitters

- Cardiology

- SPECT

- PET

- Therapeutic Applications

- Neurology

- Oncology

- Thyroid

- SPECT

- Therapeutic Applications

- Lymphoma

- Bone Metastasis

- SPECT

- Therapeutic Applications

- Endocrine Tumor

- Pulmonary Scans

- Others

- Hospitals & Clinics

- Diagnostic Centers

- Others

https://www.novaoneadvisor.com/report/checkout/8497

Frequently Asked Questions

- What geographic regions does your market research cover for the U.S. Nuclear Medicine market?

- We have a global reach, with expertise spanning across continents, including North America, Europe, Asia-Pacific, Latin America, and the Middle East. We leverage a combination of primary and secondary research methodologies to offer country-level analysis.

- How does your firm conduct cross-sectional analysis for the U.S. Nuclear Medicine market?

- We conduct cross-sectional analysis by examining data from different individuals at a single point in time to identify patterns and trends across diverse segments of the market.

- Can your firm customize market research solutions to meet specific client needs?

- Our experienced team works closely with clients to gain a thorough understanding of their business goals and target markets. We have the expertise and flexibility to develop bespoke research solutions.

- Do you offer ongoing support or consultation to clients after the completion of a market research project?

- Our team of experienced analysts is available to address any questions, concerns and needs that may arise following the delivery of the report.

- Can your market research firm help with competitor analysis for U.S. Nuclear Medicine market?

- Through a combination of quantitative and qualitative research methodologies, we meticulously assess the strengths, weaknesses, strategies, and market positioning of your competitors.

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/