According to latest report, the U.S. pharmaceutical market size was USD 602.19 billion in 2023, calculated at USD 639.22 billion in 2024 and is expected to reach around USD 1,093.79 billion by 2033, expanding at a CAGR of 6.15% from 2024 to 2033.

The U.S. pharmaceutical industry, renowned for developing innovative drugs with significant medical benefits, is a crucial driver of growth in the healthcare sector. The high cost of many new medications has contributed to escalating healthcare expenses for both the private sector and the federal government. Policymakers are actively exploring measures to reduce drug prices and lower federal expenditures on drugs. These expenditures encompass a range of activities, including the discovery and testing of new drugs, the development of incremental innovations such as product extensions, and clinical testing for safety monitoring and marketing purposes. The PhRMA Equity Initiative, through strategic partnerships across the country, is committed to fostering a more representative workforce and creating an equitable healthcare system, further fueling the expansion of the U.S. pharmaceutical market.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.novaoneadvisor.com/report/sample/8457

U.S. Pharmaceutical Market Overview

The U.S. pharmaceutical market is experiencing rapid growth, driven by a robust pipeline of specialty drugs and an increasing number of brand name pharmaceutical manufacturers, which grew by 7.8% to 2,325 businesses in 2023. The U.S. Pharmacopeia (USP), an independent, scientific nonprofit organization, plays a critical role in ensuring the supply of safe, quality medicines by strengthening the global supply chain. The U.S. leads the world in per capita prescription drug spending, accounting for 30-40% of the global market and 45% of global pharmaceutical sales, with 22% of global production. The industry has benefited significantly from policies like the Affordable Care Act, bolstering profitability. In 2023, the FDA approved 55 new drugs, reflecting a rebound in approvals and strategic acquisitions by pharmaceutical companies seeking to enhance their portfolios ahead of patent expirations. The sector's output and sales remain strong, supported by the global vaccination rollout and sustained demand for medical treatments.

Global Pharmaceutical Market Size and Share Report, 2033

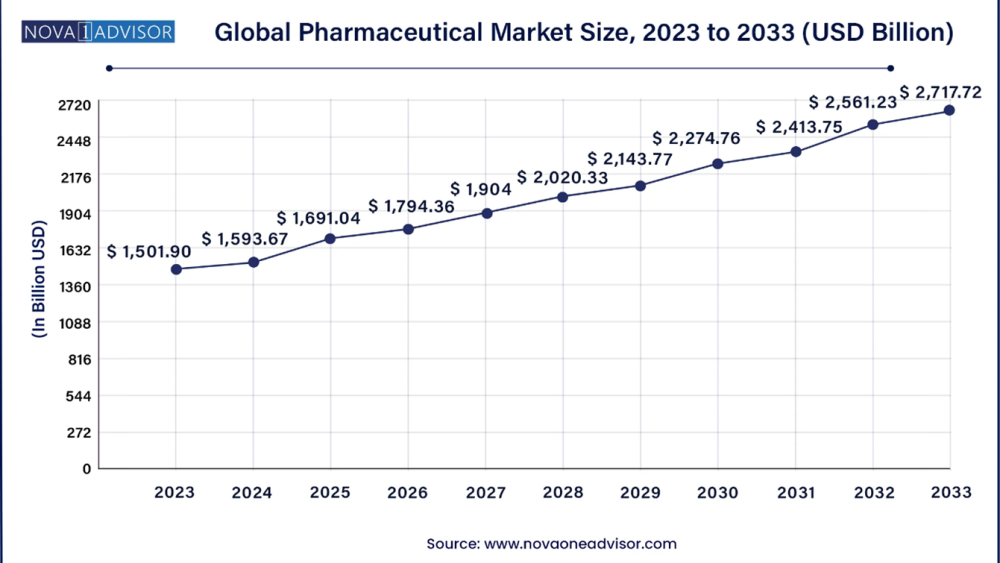

The global pharmaceutical market size was estimated at USD 1,593.67 billion in 2024 and is projected to hit around USD 2,717.72 billion by 2033, growing at a CAGR of 6.11% during the forecast period from 2024 to 2033. North America dominated the pharmaceutical Industry with the largest revenue share of 41.09% in 2023.

U.S. Pharmaceutical Market Report Highlights

By Molecule Type

The market for conventional drugs, primarily composed of small molecules, continues to dominate the pharmaceutical landscape. Conventional medicine, practiced by health professionals with M.D. or D.O. degrees, as well as nurses, pharmacists, physician assistants, and therapists, addresses symptoms and diseases through drugs, radiation, or surgery. This system, also known as allopathic, biomedicine, Western, mainstream, or orthodox medicine, remains the cornerstone of healthcare. Some practitioners of conventional medical care also engage in complementary and alternative medicine (CAM), further broadening the scope and integration of treatment methodologies.

The biologics and biosimilars segment is poised for rapid growth, with the fastest compound annual growth rate (CAGR) in the pharmaceutical market. Biosimilars, which are highly similar to and have no clinically meaningful differences from existing biologic medicines (reference products) licensed by the U.S. Food and Drug Administration (FDA), are a key driver of this growth. By the end of 2022, 40 biosimilars had been approved, and 27 were actively competing against ten brand biologics in the U.S. market, with several more launches anticipated throughout 2023. This segment's expansion is set to significantly impact the landscape of biologic treatments, offering more cost-effective alternatives and enhancing market competition.

By Product

The branded segment continues to dominate the pharmaceutical market, capturing a significant revenue share. Drug companies develop new medications as brand name drugs, securing patent protection to safeguard their investment in research and development. This exclusive right allows them to manufacture and sell the brand name drug during the patent's duration. These drugs are marketed under a branded (trade or proprietary) name, crafted by the manufacturer to be easily recognizable and memorable. This strategy not only reinforces market presence but also maximizes the return on investment by ensuring brand loyalty and market differentiation.

The growth of the generic segment is driven by an increasing number of Abbreviated New Drug Application (ANDA) approvals and subsequent generic drug launches. Generic drugs, which can only be marketed after the expiration of the brand name drug's patent often up to 20 years after the original filing with the U.S. Food and Drug Administration (FDA) contain the same active ingredients and provide identical therapeutic effects as their branded counterparts. They match the brand name drugs in dosing, safety, strength, quality, mechanism of action, administration method, and usage guidelines. This ensures that generics offer a cost-effective alternative while maintaining the same standards of efficacy and safety.

By Type

The prescription segment maintained a dominant market share, characterized by drugs prescribed by doctors, purchased at pharmacies, intended for individual use, and regulated by the FDA through the New Drug Application (NDA) process. This formal step allows drug sponsors to seek FDA approval for marketing new drugs in the United States. Conversely, the over-the-counter (OTC) segment is poised for the fastest growth, driven by the high cost of prescription pharmaceuticals and a resulting shift towards OTC alternatives. This growth is further supported by the increasing approval of OTC drugs, making them more accessible and appealing to cost-conscious consumers.

The over-the-counter (OTC) segment is anticipated to experience the fastest growth in the pharmaceutical market, driven by the high cost of prescription (Rx) pharmaceuticals and a consequent shift towards OTC alternatives. These drugs, which do not require a doctor's prescription and can be purchased off-the-shelf in stores, are becoming increasingly popular. This growth is further supported by the rising approval of OTC pharmaceuticals. In June 2022, the FDA announced the proposed rule "Nonprescription Drug Product with an Additional Condition for Nonprescription Use, aimed at increasing the development and marketing options for safe and effective nonprescription drug products. This initiative is expected to enhance public health by broadening the range of nonprescription drug products available to consumers.

By Disease

Based on disease, the cancer segment dominated the overall pharmaceutical market share. In 2023, an estimated 1.69 million new cancer cases were diagnosed, and 609,360 cancer deaths occurred in the United States. Current statistics project that approximately 611,720 people will die from cancer in 2024, equating to around 1,680 deaths per day. Cancer remains the second-leading cause of death in the United States and the leading cause among individuals younger than 85 years. The American Cancer Society meticulously estimates new cancer cases and deaths, utilizing the latest population-based incidence and outcomes data collected by central cancer registries, underscoring the significant and ongoing impact of this disease on public health.

Furthermore, the neurological disorders segment is expected to witness the fastest compound annual growth rate (CAGR). Neurologic disorders, including neurodegenerative diseases such as Alzheimer’s disease, Parkinson’s disease, amyotrophic lateral sclerosis (ALS), and other motor neuron diseases, collectively affect nearly 7 million people in the U.S. The economic burden of major neurologic diseases is approximately $800 billion annually, with Alzheimer's disease and other dementias being the largest contributors to this figure. This significant impact underscores the urgent need for advancements in treatment and care within the neurological disorders segment.

By Route of Administration

Based on the route of administration, the oral route commands the largest market share. Widely favored for its convenience, safety, and cost-effectiveness, oral administration is the most commonly used method. Its effectiveness can be limited by the drug's journey through the digestive tract, where absorption begins primarily in the mouth and stomach. This route's popularity stems from its ease of use and broad applicability across a wide range of pharmaceutical formulations, potential challenges in absorption variability.

The parenteral route of administration is projected to achieve the fastest compound annual growth rate (CAGR) in the forecast period. This method offers several advantages, including the precise and rapid delivery of medication directly into tissues or the circulatory system through injection, bypassing liver metabolism. It is particularly beneficial for patients experiencing nausea, vomiting, or difficulty swallowing, or those requiring medications that may irritate the gastrointestinal tract. Unlike the enteral route, which can have variable drug bioavailability, parenteral drugs administered intravenously ensure 100% bioavailability, enhancing therapeutic efficacy and reliability. This expansion underscores its increasing adoption in clinical settings where immediate and reliable drug delivery is critical.

By Formulation

Tablets maintain the largest market share in the pharmaceutical industry, serving as integral products in drug formulation. Their design and manufacturing processes are intricate, involving multiple steps to ensure precise delivery of the correct drug substance in the right form, amount, and timing while preserving chemical integrity for desired therapeutic outcomes. This includes various types such as ordinary tablets without coating, sugar-coated tablets with a sugar coating, and film-coated tablets where a polymer material is used for coating. These formulations cater to diverse patient needs and preferences, reflecting ongoing advancements in pharmaceutical technology and consumer demand for effective and convenient medication options.

The sprays segment is anticipated to achieve the fastest compound annual growth rate (CAGR) in the pharmaceutical market over the forecast period. Sprays represent a distinct pharmaceutical dosage form reliant on the container's functionality, valve assembly, and propellants for effective ingredient delivery. Known as pressurized packages, these aerosol containers utilize liquefied or gaseous propellants to create internal pressure. Upon valve activation, this pressure expels the formulation through the valve opening, with the physical characteristics of the expelled contents determined by the product formulation and valve type. This formulation method ensures precise and efficient delivery of medications, catering to evolving consumer preferences and therapeutic needs in the healthcare sector.

By Age Group Insights

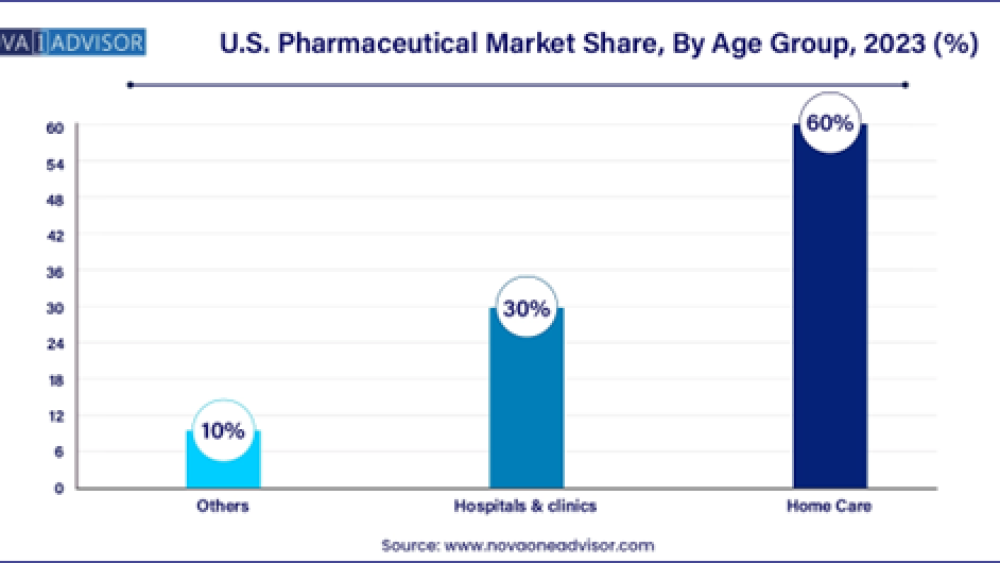

The adult segment held the largest share of 60.00% in the pharmaceuticals market in 2023 and is further expected to advance at the fastest growth rate over the forecast period. The higher prevalence of geriatric as well as adult population is likely to increase the demand of prescription medicines. As per the CDC, in the U.S., around 69.0%, and in Canada, around 65.5% (nearly 7 in 10 persons) aged 40-79 years used at least one prescription drug. The most commonly used drugs among the adult population include lipid-lowering drugs, ACE inhibitors, analgesics, and antidepressants.

The children & adolescent segment is expected to witness steady growth from 2024 to 2033. This growth is likely due to the rising number of medication approvals for the pediatric population. For instance, in June 2023, Pfizer Inc., in collaboration with OPKO Health Inc., received FDA approval for NGENLA, a human growth hormone medication used to treat pediatric patients. It is expected to be available for prescription in August 2023. A rising prevalence of various disorders in this population, including respiratory conditions, infectious diseases, and rare conditions, is further anticipated to fuel segment growth.

By End Market

In the pharmaceuticals market, the hospitals segment has emerged as the dominant end user. With approximately 6,120 hospitals across the United States, including academic medical centers and teaching hospitals among nonfederal short-term facilities, this sector represents a substantial portion of pharmaceutical consumption. Hospitals and health systems, totaling over 6,200 and 400 respectively, serve as crucial stakeholders shaping healthcare delivery nationwide. Their significant role as the primary providers of acute and specialized care underscores their influence in pharmaceutical procurement and usage trends. This segment's robust demand reflects ongoing partnerships and strategic initiatives within the healthcare industry aimed at enhancing patient outcomes and operational efficiencies.

Clinics are poised to experience the fastest compound annual growth rate (CAGR) in the forecast period within the pharmaceuticals market. With 31,748 clinics spread across the USA, encompassing medical, mental health, and women's health clinics, this segment forms a vital component of the healthcare landscape. Clinics play a crucial role in delivering comprehensive medical care, underscoring the nation's commitment to healthcare excellence and contributing to a well-structured healthcare system. Texas leads with 4,661 clinics, showcasing robust healthcare infrastructure, closely followed by California with 4,584 clinics. States like Washington, Missouri, and Minnesota also rank prominently, reflecting strong healthcare systems and their pivotal role in meeting the healthcare needs of their populations. This growth highlights increasing demand for medical services and underscores the strategic importance of clinics in healthcare delivery.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/8457

U.S. Pharmaceutical Market Dynamics

Driver

Restraint

Opportunity

Immediate Delivery Available | Buy This Premium Research

https://www.novaoneadvisor.com/report/checkout/8457

U.S. Pharmaceutical Market Top Key Companies:

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Pharmaceutical market.

By Molecule Type

About Us

Nova One Advisor is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Nova One Advisor has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defines, among different ventures present globally.

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/

The U.S. pharmaceutical industry, renowned for developing innovative drugs with significant medical benefits, is a crucial driver of growth in the healthcare sector. The high cost of many new medications has contributed to escalating healthcare expenses for both the private sector and the federal government. Policymakers are actively exploring measures to reduce drug prices and lower federal expenditures on drugs. These expenditures encompass a range of activities, including the discovery and testing of new drugs, the development of incremental innovations such as product extensions, and clinical testing for safety monitoring and marketing purposes. The PhRMA Equity Initiative, through strategic partnerships across the country, is committed to fostering a more representative workforce and creating an equitable healthcare system, further fueling the expansion of the U.S. pharmaceutical market.

The Full Study is Readily Available | Download the Sample Pages of this Report@ https://www.novaoneadvisor.com/report/sample/8457

U.S. Pharmaceutical Market Overview

The U.S. pharmaceutical market is experiencing rapid growth, driven by a robust pipeline of specialty drugs and an increasing number of brand name pharmaceutical manufacturers, which grew by 7.8% to 2,325 businesses in 2023. The U.S. Pharmacopeia (USP), an independent, scientific nonprofit organization, plays a critical role in ensuring the supply of safe, quality medicines by strengthening the global supply chain. The U.S. leads the world in per capita prescription drug spending, accounting for 30-40% of the global market and 45% of global pharmaceutical sales, with 22% of global production. The industry has benefited significantly from policies like the Affordable Care Act, bolstering profitability. In 2023, the FDA approved 55 new drugs, reflecting a rebound in approvals and strategic acquisitions by pharmaceutical companies seeking to enhance their portfolios ahead of patent expirations. The sector's output and sales remain strong, supported by the global vaccination rollout and sustained demand for medical treatments.

- In April 2024, the U.S.-India Medicine Partnership highlighted India's contributions to the U.S. healthcare system.

- In January 2024, Taro announced a merger agreement with Sun Pharma.

- Based on molecule type, the market for conventional drugs (small molecules) dominated the market with a revenue share of 56.21% in 2023.

- The biologics& biosimilar segment is expected to witness growth with the fastest CAGR from 2024 to 2033.

- The branded segment dominated the pharmaceutical market with a revenue share of 68.19% in 2023.

- The prescription segment held a dominant revenue share of 88.23% in 2023 in the market

- Based on disease, the cancer segment dominated the overall market with share of 16.79% in 2023

- The neurological disorders segment is expected to witness growth with fastest CAGR from 2024 to 2033.

- Based on the route of administration, the oral route dominated the market with a revenue share of 59.9 % in 2023.

- The parenteral route of administration is expected to expand at the fastest CAGR over the forecast period.

- Tablets held the largest market share in 2023 in the pharmaceuticals market.

- The sprays segment is expected to grow at the fastest CAGR over the forecast period.

- The adult segment held the largest share of 60.00% in the pharmaceuticals market in 2023 and is further expected to advance at the fastest growth rate over the forecast period.

- The children & adolescent segment is expected to witness steady growth from 2024 to 2033.

- Based on the end market, the hospitals segment dominated the pharmaceuticals market, with a revenue share of 51.66% in 2023.

- Clinics are estimated to expand at the fastest CAGR from 2024 to 2033.

Global Pharmaceutical Market Size and Share Report, 2033

The global pharmaceutical market size was estimated at USD 1,593.67 billion in 2024 and is projected to hit around USD 2,717.72 billion by 2033, growing at a CAGR of 6.11% during the forecast period from 2024 to 2033. North America dominated the pharmaceutical Industry with the largest revenue share of 41.09% in 2023.

U.S. Pharmaceutical Market Report Highlights

By Molecule Type

The market for conventional drugs, primarily composed of small molecules, continues to dominate the pharmaceutical landscape. Conventional medicine, practiced by health professionals with M.D. or D.O. degrees, as well as nurses, pharmacists, physician assistants, and therapists, addresses symptoms and diseases through drugs, radiation, or surgery. This system, also known as allopathic, biomedicine, Western, mainstream, or orthodox medicine, remains the cornerstone of healthcare. Some practitioners of conventional medical care also engage in complementary and alternative medicine (CAM), further broadening the scope and integration of treatment methodologies.

The biologics and biosimilars segment is poised for rapid growth, with the fastest compound annual growth rate (CAGR) in the pharmaceutical market. Biosimilars, which are highly similar to and have no clinically meaningful differences from existing biologic medicines (reference products) licensed by the U.S. Food and Drug Administration (FDA), are a key driver of this growth. By the end of 2022, 40 biosimilars had been approved, and 27 were actively competing against ten brand biologics in the U.S. market, with several more launches anticipated throughout 2023. This segment's expansion is set to significantly impact the landscape of biologic treatments, offering more cost-effective alternatives and enhancing market competition.

By Product

The branded segment continues to dominate the pharmaceutical market, capturing a significant revenue share. Drug companies develop new medications as brand name drugs, securing patent protection to safeguard their investment in research and development. This exclusive right allows them to manufacture and sell the brand name drug during the patent's duration. These drugs are marketed under a branded (trade or proprietary) name, crafted by the manufacturer to be easily recognizable and memorable. This strategy not only reinforces market presence but also maximizes the return on investment by ensuring brand loyalty and market differentiation.

The growth of the generic segment is driven by an increasing number of Abbreviated New Drug Application (ANDA) approvals and subsequent generic drug launches. Generic drugs, which can only be marketed after the expiration of the brand name drug's patent often up to 20 years after the original filing with the U.S. Food and Drug Administration (FDA) contain the same active ingredients and provide identical therapeutic effects as their branded counterparts. They match the brand name drugs in dosing, safety, strength, quality, mechanism of action, administration method, and usage guidelines. This ensures that generics offer a cost-effective alternative while maintaining the same standards of efficacy and safety.

By Type

The prescription segment maintained a dominant market share, characterized by drugs prescribed by doctors, purchased at pharmacies, intended for individual use, and regulated by the FDA through the New Drug Application (NDA) process. This formal step allows drug sponsors to seek FDA approval for marketing new drugs in the United States. Conversely, the over-the-counter (OTC) segment is poised for the fastest growth, driven by the high cost of prescription pharmaceuticals and a resulting shift towards OTC alternatives. This growth is further supported by the increasing approval of OTC drugs, making them more accessible and appealing to cost-conscious consumers.

The over-the-counter (OTC) segment is anticipated to experience the fastest growth in the pharmaceutical market, driven by the high cost of prescription (Rx) pharmaceuticals and a consequent shift towards OTC alternatives. These drugs, which do not require a doctor's prescription and can be purchased off-the-shelf in stores, are becoming increasingly popular. This growth is further supported by the rising approval of OTC pharmaceuticals. In June 2022, the FDA announced the proposed rule "Nonprescription Drug Product with an Additional Condition for Nonprescription Use, aimed at increasing the development and marketing options for safe and effective nonprescription drug products. This initiative is expected to enhance public health by broadening the range of nonprescription drug products available to consumers.

By Disease

Based on disease, the cancer segment dominated the overall pharmaceutical market share. In 2023, an estimated 1.69 million new cancer cases were diagnosed, and 609,360 cancer deaths occurred in the United States. Current statistics project that approximately 611,720 people will die from cancer in 2024, equating to around 1,680 deaths per day. Cancer remains the second-leading cause of death in the United States and the leading cause among individuals younger than 85 years. The American Cancer Society meticulously estimates new cancer cases and deaths, utilizing the latest population-based incidence and outcomes data collected by central cancer registries, underscoring the significant and ongoing impact of this disease on public health.

Furthermore, the neurological disorders segment is expected to witness the fastest compound annual growth rate (CAGR). Neurologic disorders, including neurodegenerative diseases such as Alzheimer’s disease, Parkinson’s disease, amyotrophic lateral sclerosis (ALS), and other motor neuron diseases, collectively affect nearly 7 million people in the U.S. The economic burden of major neurologic diseases is approximately $800 billion annually, with Alzheimer's disease and other dementias being the largest contributors to this figure. This significant impact underscores the urgent need for advancements in treatment and care within the neurological disorders segment.

By Route of Administration

Based on the route of administration, the oral route commands the largest market share. Widely favored for its convenience, safety, and cost-effectiveness, oral administration is the most commonly used method. Its effectiveness can be limited by the drug's journey through the digestive tract, where absorption begins primarily in the mouth and stomach. This route's popularity stems from its ease of use and broad applicability across a wide range of pharmaceutical formulations, potential challenges in absorption variability.

The parenteral route of administration is projected to achieve the fastest compound annual growth rate (CAGR) in the forecast period. This method offers several advantages, including the precise and rapid delivery of medication directly into tissues or the circulatory system through injection, bypassing liver metabolism. It is particularly beneficial for patients experiencing nausea, vomiting, or difficulty swallowing, or those requiring medications that may irritate the gastrointestinal tract. Unlike the enteral route, which can have variable drug bioavailability, parenteral drugs administered intravenously ensure 100% bioavailability, enhancing therapeutic efficacy and reliability. This expansion underscores its increasing adoption in clinical settings where immediate and reliable drug delivery is critical.

By Formulation

Tablets maintain the largest market share in the pharmaceutical industry, serving as integral products in drug formulation. Their design and manufacturing processes are intricate, involving multiple steps to ensure precise delivery of the correct drug substance in the right form, amount, and timing while preserving chemical integrity for desired therapeutic outcomes. This includes various types such as ordinary tablets without coating, sugar-coated tablets with a sugar coating, and film-coated tablets where a polymer material is used for coating. These formulations cater to diverse patient needs and preferences, reflecting ongoing advancements in pharmaceutical technology and consumer demand for effective and convenient medication options.

The sprays segment is anticipated to achieve the fastest compound annual growth rate (CAGR) in the pharmaceutical market over the forecast period. Sprays represent a distinct pharmaceutical dosage form reliant on the container's functionality, valve assembly, and propellants for effective ingredient delivery. Known as pressurized packages, these aerosol containers utilize liquefied or gaseous propellants to create internal pressure. Upon valve activation, this pressure expels the formulation through the valve opening, with the physical characteristics of the expelled contents determined by the product formulation and valve type. This formulation method ensures precise and efficient delivery of medications, catering to evolving consumer preferences and therapeutic needs in the healthcare sector.

By Age Group Insights

The adult segment held the largest share of 60.00% in the pharmaceuticals market in 2023 and is further expected to advance at the fastest growth rate over the forecast period. The higher prevalence of geriatric as well as adult population is likely to increase the demand of prescription medicines. As per the CDC, in the U.S., around 69.0%, and in Canada, around 65.5% (nearly 7 in 10 persons) aged 40-79 years used at least one prescription drug. The most commonly used drugs among the adult population include lipid-lowering drugs, ACE inhibitors, analgesics, and antidepressants.

The children & adolescent segment is expected to witness steady growth from 2024 to 2033. This growth is likely due to the rising number of medication approvals for the pediatric population. For instance, in June 2023, Pfizer Inc., in collaboration with OPKO Health Inc., received FDA approval for NGENLA, a human growth hormone medication used to treat pediatric patients. It is expected to be available for prescription in August 2023. A rising prevalence of various disorders in this population, including respiratory conditions, infectious diseases, and rare conditions, is further anticipated to fuel segment growth.

By End Market

In the pharmaceuticals market, the hospitals segment has emerged as the dominant end user. With approximately 6,120 hospitals across the United States, including academic medical centers and teaching hospitals among nonfederal short-term facilities, this sector represents a substantial portion of pharmaceutical consumption. Hospitals and health systems, totaling over 6,200 and 400 respectively, serve as crucial stakeholders shaping healthcare delivery nationwide. Their significant role as the primary providers of acute and specialized care underscores their influence in pharmaceutical procurement and usage trends. This segment's robust demand reflects ongoing partnerships and strategic initiatives within the healthcare industry aimed at enhancing patient outcomes and operational efficiencies.

Clinics are poised to experience the fastest compound annual growth rate (CAGR) in the forecast period within the pharmaceuticals market. With 31,748 clinics spread across the USA, encompassing medical, mental health, and women's health clinics, this segment forms a vital component of the healthcare landscape. Clinics play a crucial role in delivering comprehensive medical care, underscoring the nation's commitment to healthcare excellence and contributing to a well-structured healthcare system. Texas leads with 4,661 clinics, showcasing robust healthcare infrastructure, closely followed by California with 4,584 clinics. States like Washington, Missouri, and Minnesota also rank prominently, reflecting strong healthcare systems and their pivotal role in meeting the healthcare needs of their populations. This growth highlights increasing demand for medical services and underscores the strategic importance of clinics in healthcare delivery.

Immediate Delivery Available, Get Full Access@ https://www.novaoneadvisor.com/report/checkout/8457

U.S. Pharmaceutical Market Dynamics

Driver

- R&D Intensity and Investment

Restraint

- Domestic Capacity and Dependence on Foreign APIs

Opportunity

- Continuous Manufacturing Innovations

Immediate Delivery Available | Buy This Premium Research

https://www.novaoneadvisor.com/report/checkout/8457

U.S. Pharmaceutical Market Top Key Companies:

- Abbvie

- Astrazeneca

- Bristrol Myers Squibb

- GSK

- Johnson & Johnson

- Merck & Co

- Novartis

- Pfizer

- Roche Holding

- Sanofi

- In December 2023, Pfizer received all regulatory approvals for the acquisition of Seagen. This initiative aims to bring commercial changes in the organization thereby creating a new space, the Pfizer Oncology Division to integrate oncology commercial and R&D operations from both the companies.

- In January 2023, Sun Pharma announced the launch of a new drug, SEZABY for treating neonatal seizures in the U.S. This is the first USFDA-approved drug for term and pre-term babies.

- In March 2024, Roquette executed a strategic move by finalizing an acquisition agreement to purchase IFF Pharma Solutions.

- In March 2024, AstraZeneca expanded its late-stage rare disease pipeline through the acquisition of Amolyt Pharma.

- In April 2023, Sanofi successfully concluded its acquisition of Provention Bio, Inc.

- In November 2023, Astellas announced its acquisition of Propella Therapeutics.

- In July 2023, Biogen finalized its acquisition of Reata Pharmaceuticals.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the U.S. Pharmaceutical market.

By Molecule Type

- Biologics & Biosimilars (Large Molecules)

- Monoclonal Antibodies

- Vaccines

- Cell & Gene Therapy

- Others

- Conventional Drugs (Small Molecules)

- Branded

- Generics

- Prescription

- OTC

- Cardiovascular diseases

- Cancer

- Diabetes

- Infectious diseases

- Neurological disorders

- Respiratory diseases

- Autoimmune diseases

- Mental health disorders

- Gastrointestinal disorders

- Women’s health diseases

- Genetic and rare genetic diseases

- Dermatological conditions

- Obesity

- Renal diseases

- Liver conditions

- Hematological disorders

- Eye conditions

- Infertility conditions

- Endocrine disorders

- Allergies

- Others

- Oral

- Topical

- Parenteral

- Intravenous

- Intramuscular

- Inhalations

- Other Route of Administration

- Tablets

- Capsules

- Injectable

- Sprays

- Suspensions

- Powders

- Other Formulations

- Children & Adolescents

- Adults

- Geriatric

- Hospitals

- Clinics

- Others

- North America

- U.S.

- Canada

About Us

Nova One Advisor is a worldwide market research and consulting organization. We give an unmatched nature of offering to our customers present all around the globe across industry verticals. Nova One Advisor has expertise in giving deep-dive market insight along with market intelligence to our customers spread crosswise over various undertakings. We are obliged to serve our different client base present over the enterprises of medicinal services, healthcare, innovation, next-gen technologies, semi-conductors, chemicals, automotive, and aerospace & defines, among different ventures present globally.

Call: USA: +1 650 460 3308 | IND: +91 87933 22019 |Europe: +44 2080772818

Email: sales@novaoneadvisor.com

Web: https://www.novaoneadvisor.com/